Creating a Sub-Merchant Fee Profile

A Sub-Merchant Fee Profile is used to configure how to charge your sub-merchants for transactions (for example, by method of payment, by transaction type, a flat fee versus a percentage fee, etc.) in order to facilitate Sub-Merchant Funding. You create custom fee profiles using the PayFac Portal, then assign a fee profile to each sub-merchant.

After associating a fee profile with a sub-merchant, and the sub-merchant starts processing transactions, Worldpay calculates the fees the sub-merchant owes you and disperses the funds to you and the sub-merchant accordingly. This enables you to fund sub-merchants as early as the next day, and avoids the need to establish a banking relationship, separate integrations, and a complex billing engine.

You can configure a fee profile to contain any of the following fees for approved and declined transactions for Visa, MasterCard, Discover acquired, American Express acquired, and eChecks:

For Approved Transactions:

-

Deposits - flat rate and/or a percent rate for each method of payment

-

Chargebacks - flat rate for first chargebacks and refund chargebacks for each credit card payment type, and flat rate for eCheck returns

-

Refunds - flat rate for each method of payment

-

Authorizations - flat rate for authorizations and authorization reversals for each method of payment

For Declined Transactions:

-

Deposits - flat rate and/or a percent rate for each method of payment

-

Refunds - flat rate for each method of payment

-

Authorizations - flat rate for authorizations and authorization reversals for each method of payment

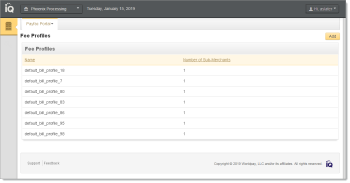

The Fee Profiles page of the PayFac Portal (figure below) lists the Fee Profiles that were previously created, along with the number of Sub-Merchants associated with each profile.